Millennium worked with the MFCU team to develop objectives that aligned with the credit union’s goals and developed analytics strategies to track, monitor, and optimize each campaign

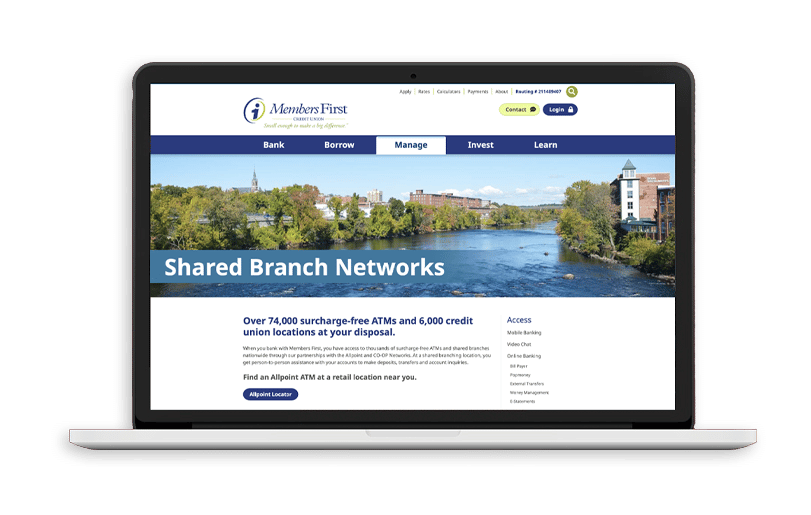

Members First Credit Union was first established as the Manchester Municipal Employees Credit Union by firefighter John Walsh in 1949. John operated the credit union from his briefcase at the Somerville Street Fire Station in Manchester. In 1950, John’s idea of helping local firefighters with their finances grew and the credit union officially moved into Manchester’s City Hall on Elm Street. After 31 years of continuous growth and popularity, the need for a more spacious facility became apparent, so in 1981 the credit union moved out of City Hall to 44 Bridge Street in Manchester. A second Manchester office was opened at 200 Union Street in 1994 to serve the growing municipal employee workforce. The credit union wanted to increase their online digital marketing presence and contracted through LMC Spotlight to Millennium Agency to execute the digital marketing plan.

Millennium Agency conducted a deep dive into the Members First Credit Union demographics. The team was able to execute the creative developed by LMC Spotlight for several campaigns, focusing on key buyer personas that were accurate and highly valuable for lead generation. We worked with the team to develop objectives that align with the credit union’s goals, and developed analytics strategies to track, monitor, and optimize each campaign whether paid search, retargeting, display, Spotify and/or video advertising.

The digital marketing strategy was a tremendous success. Millennium Agency provided Members First Credit Union with a successful digital strategy and direction, enabling them to benefit from highly successful lead digital initiatives. The results were beyond successful which led to new accounts and additional balances, HELOC, and direct closes. For a two and half month period, the following was recorded. Eight Home Equity Loans totaling $404,943 were generated during the campaign period, compared to four loans totaling $340,099 the previous year, resulting in twice the number of loans and 16% more loan volume year over year.

Take the first step in growing your brand and connect with our expert branding, marketing, and messaging strategy team today.